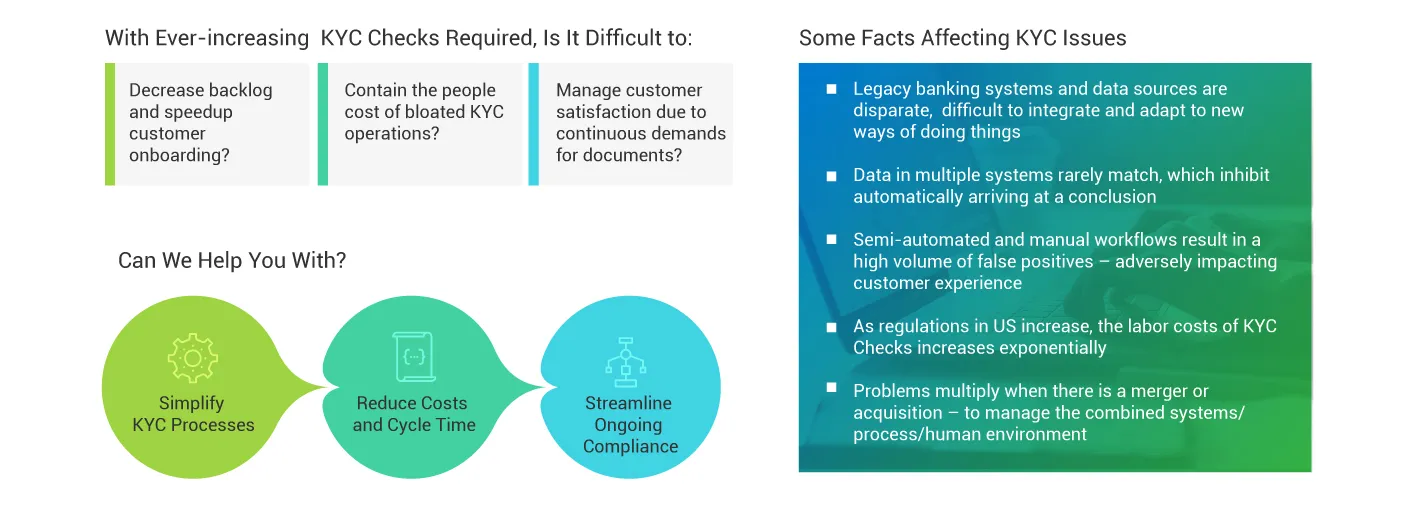

Simplify KYC Processes, Reduce Costs and Increase Workforce Productivity

According to Thomson Reuters, 85% of corporate banking customers are dissatisfied with their account opening experience. To improve their Know Your Customer (KYC) processes, banks need to replace manual, paper-based onboarding with a solution that accelerates activation, increases customer satisfaction and reduces costs.

X·CELERATE eKYC leverages best of breed cloud, data lake, AI and ML capabilities to facilitate onboarding and compliance-related decision making with actionable data. Powered by Xoriant SmartCapture technology, the solution rapidly scans and checks high-volume support documents, while AI/ML-enabled workflows significantly reduce errors. For touchless/frictionless customer account openings, X·CELERATE eKYC deploys quickly to improve productivity and operational efficiency, while reducing your TCO.

Solve Your Data Capture and Processing Challenges

Compliance Checks at Account Opening

Provides decision support via customer risk profile creation, OFAC and necessary KYC checks prior to account opening.

Enhances collaboration with flexible workflows enabling alert resolution in an intuitive, Facebook-like fashion

Digitizes KYC process steps, leveraging intelligent text extraction for superior customer experience

Recurring Compliance

Checks

Delivers efficient compliance validations on a recurring basis after account opening.

Supports customer risk profile creation and recurring KYC evaluations.

Regulatory and Operational Reporting

Offers a robust, fully customizable engine for generating tailored regulatory, audit and operational reports

Creates customized reports such as the AML Preview, FinCEN and numerous operational reports

Offers a comprehensive dashboard and decision support for KYC evaluation prior to account onboarding

Compliance Checks at Account Opening

Provides decision support via customer risk profile creation, OFAC and necessary KYC checks prior to account opening.

Enhances collaboration with flexible workflows enabling alert resolution in an intuitive, Facebook-like fashion

Digitizes KYC process steps, leveraging intelligent text extraction for superior customer experience

Recurring Compliance

Checks

Delivers efficient compliance validations on a recurring basis after account opening.

Supports customer risk profile creation and recurring KYC evaluations.

Regulatory and Operational Reporting

Offers a robust, fully customizable engine for generating tailored regulatory, audit and operational reports

Creates customized reports such as the AML Preview, FinCEN and numerous operational reports

Offers a comprehensive dashboard and decision support for KYC evaluation prior to account onboarding

Middle Text Head

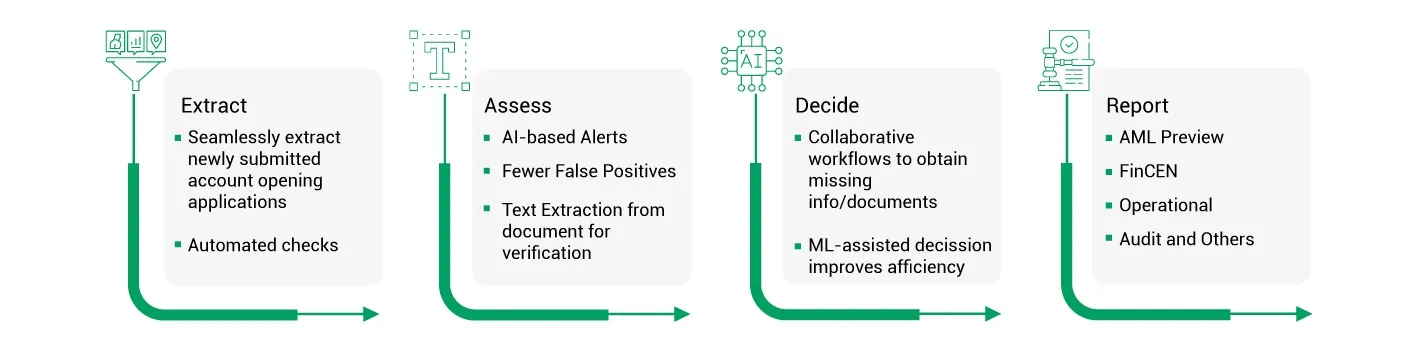

How Does This Solution Work?

How Does This Solution Work?

Middle Text

Solve the KYC Checks Challenges at Account Opening and Thereafter

Learn About the Xoriant-Microsoft Partnership

Trends Title

Explore Industry Trends and Insights

Explore Industry Trends and Insights

Improved KYC Processing Efficiency by 46%

Get Started

With Xoriant