The world of digital payments is constantly evolving as disruption and unpredictability become mainstays. Evolving customer expectations, technical advancements, and changing market dynamics are driving innovation and adoption in the digital payments landscape. The pandemic accelerated the push toward digital payments innovation and drove a behavior shift that promises to last long. Digital payment innovation now is prioritizing speed, frictionless transactions, and decentralized models that add agility.

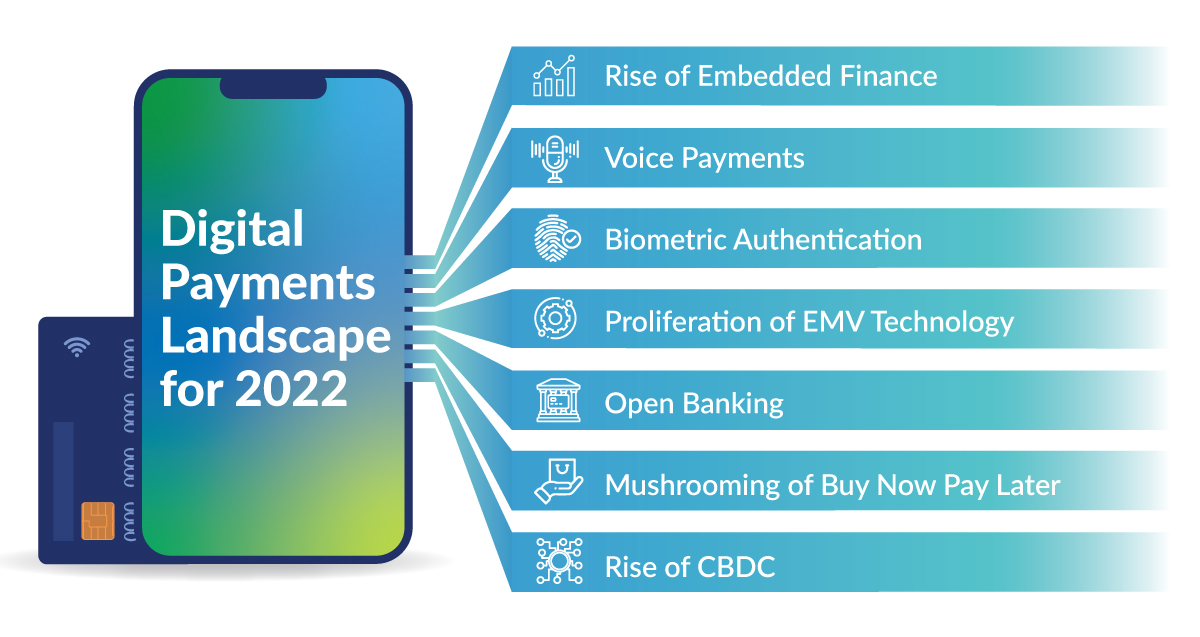

Some of the areas to watch out for in the digital payments landscape for 2022 are:

Rise of Embedded Finance

Embedded finance is expected to be a huge driving force of innovation this year spurred on by the disintermediation of the banking landscape. Embedded finance allows any company to become a fintech player, offer financial products, and deliver better customer service often at a lower cost.

Embedded finance promises to make complex and expensive banking infrastructure much more accessible. It is a financial service offered outside the typical “going to the bank” concept. It streamlines access to financial services without redirecting the customer to third-party destinations

Embedded finance is also changing the way payments are made. Companies such as Amazon, Uber, BBVA have adopted embedded finance. Consumers are demanding convenient, frictionless ways to make payments while using various devices from wallets to wearables. Contextual payment options like embedded payments make the payment process more convenient and seamless.

Embedded finance also removes the barriers to entry for various products and services and streamlines financial processes in both consumer and business commerce. It has flexibility and universality that can be applied to any organization or industry with a transactional element.

At the core, embedded finance is a digital product and needs providers to view their financial products through a technical lens. With technological advancements, the use of application programming interfaces (APIs) to integrate financial services within a digital ecosystem has helped embedded finance take off.

As technological advancements continue, retailers and merchants are exploring how embedded finance can complement their revenues. This is also leading to the rise of banking-as-a-service to create new use cases and revenue streams.

Voice Payments

2022 is also witnessing the rise of Voice Payments. The voice-based payments market was valued at USD 5.89 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030. Royal Bank of Canada, Barclays, and Santander have introduced voice recognition payments via Siri.

The application of technology is changing how we interact with our devices by allowing us to “tell” them what we need. This move that started with the voice-based smart assistant revolution ushered in by Siri and Alexa is now being considered the primary enabler for a significant number of people to join the digital payments revolution.

The rise of voice-based payment systems is expected to drive next-level customer experiences and equalize the playing field. Voice payments remove the need for digital literacy and awareness and eliminate these factors as entry barriers to the world of digital payments.

Voice payments allow users to discover, select, and checkout choosing to “Pay with Voice” at checkout. The voice payment system can be set up easily on preferred applications and gives users alternatives beyond OTPs, clicks, manual authentication, internet, etc.

Biometric Authentication

The Biometric authentication trend is expected to continue to grow in 2022 as problems such as identity theft and fraud become rampant. Reports from Biometric Update.com estimated that 2.5 million (approx.) payment cards were to be issued in 2021. The biometric payment card is the most complex card form-factor ever developed.

Biometric authentication is expected to rise further in prominence this year since this payment method incorporates and provides accuracy, efficiency, and security under a single umbrella.

Biometric authentication protects the digital identity and drives security in digital payments by making multi-factor authentication more airtight and banking safer and more convenient using biometrics such as fingerprints and face authentication.

Market leaders such as MasterCard and Visa have already begun working on biometric payment cards to improve the security posture and enable users to make purchases with just a scan of their fingerprint on the card’s sensor.

The Proliferation of EMV Technology

EMV technology is a standard technology used worldwide for all payments done with credit, debit, and prepaid EMV smart cards. EMV technology has been on a path of constant evolution and is now moving from cards to codes.

Previously, bank accounts would be recognized by the random number combinations on the card. EMV technology has now evolved and is become more computerized and mechanized.

The recent evolution of EMV technology employs codes that vary every time a transaction takes place. These temporary codes enhance banking security by employing cryptographic algorithms and uniquely encrypting the data each time the card is used.

11 billion credit cards are now being powered and secured with EMV technology. This technology is expected to continue on an explosive adoption path as it brings in greater security while providing global interoperability to card and mobile payments

PaaS and API-based Models Drive Open Banking

The rise of PaaS and API-based models are augmenting the rise of Open Banking. Open Banking standards are allowing traditional banks to transform into cloud-based providers of digital services to meet the ever-changing customer expectations.

Open Banking opens up access to financial data that was once concentrated in the hands of a select few banks. It allows consumers, businesses, and banks to work together using application programming interfaces (APIs) and allows third parties can offer new financial services with customer consent.

While Open Banking hasn’t created yet any disruption in the market, it is expected to become a big wave very soon. Research shows that $416 billion in revenue will be at stake as the open data wave arrives.

Neobanks, Fintechs, big techs, and other non-traditional players as such must gear up and get their strategies in place including improving their data capabilities to ride on this wave when it hits.

Mushrooming of BNPL

The Buy Now-Pay-Later installment financing concept hooked consumers last year and is expected to gain widespread adoption in 2022. Generations like Gen Z and millennials are ditching credit cards for the more user-friendly and budget-focused alternatives like BNPL models.

The rise of social eCommerce, changing demographics, and convenience is fueling the rise of BNPL as a market disruptor. We have witnessed major retailers such as GAP make BNPL options available to their customers with valuable fintech partnerships and have increased their demographic coverage.

BNPL market is expected to grow from USD 5.01 billion in 2021 at a compound annual growth rate (CAGR) of 26.0% from 2022 to 2030. Many companies such as Amazon, Walmart, Mastercard are offering BNPL options by partnering with BNPL companies to service their customers.

While this is a promising trend in digital finance, Fintech BNPL providers must carefully balance their cost of funds to their ability to assess credit risk. They also must manage bad debt and cope with increasing regulations. Financial Institutions have to focus on developing the right partners and solutions to enable these purchases and drive profits.

Rise of CBDC

CBDC or Central bank digital currency is like traditional money but in a digital form. It is issued and governed by the country’s central bank and is based on a digital ledger that may or may not employ blockchain technology. CBDC is not a cryptocurrency like Bitcoin that is governed by distributed autonomous communities. CBDC is also not value-dependent and determined entirely by the market and neither is it equivalent to electronic cash.

CBDC is a highly debated financial-sector topic globally. Every aspect of CBDC, ranging from design to implementation, are under study. As are its implications for existing financial systems. This includes its impact and influence on policy, regulation, oversight, and the economy as well.

CBDC is now being positioned as the bridge between cryptocurrencies and traditional currency and is further positioned to augment the digital payments landscape.

In Conclusion

The digital payments landscape is on the path of continuous evolution as the market becomes more competitive, dynamic, and disruptive. As disruption and technical advancements continue across the commerce and finance movement, technology adoption and innovation will continue to unlock the value and power of digital payments.

Xoriant combines engineering rigor with next-generation technology expertise to enable digital transformation and modernize applications to help the world’s leading financial services providers achieve top-line growth, bottom-line efficiency, and a competitive edge.

Check out our related PDF: Digital Payments

Want to experience the future of payments and digital banking?

Speak with Xoriant Banking Experts

View Previous Blog

View Previous Blog