Move Money & Data at the Speed of Digital Business

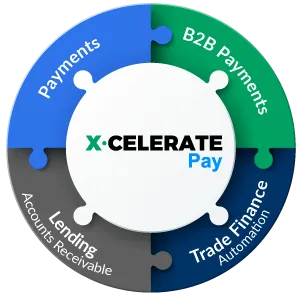

X·CELERATE Pay, a corporate payments solution, provides a modular solution of frameworks and accelerators using no-code/low code technology. The solution quickly integrates, maps, transforms, and orchestrates the transfer and receipt of funds and information safely and efficiently between your key enterprise business systems and data sources, intermediaries such as a bank or financial hub, and the receiving party.

It is the glue that fills gaps and reconciles disparities between existing fund transfer systems, including home-grown bank applications and retail software products. These diverse, standardized products require extensive integration, security management, and often impose their own processes and interfaces on users. With the corporate payments solution X·CELERATE Pay, your previous best practices and processes continue after digitization.

X·CELERATE Pay: Corporate Payments Solution Key Features

Customize, adapt and integrate into your current payments, lending or trade finance activity

Moving Data

Integrating, migrating, and refreshing data across disparate business systems and functions facilitates transactions, compliance, and time to value.Moving Money

Digital processes and modern UX reduce payment processing times and costs, and increase accuracy for commercial customers, partners and suppliers.Connect ERPs

& Business Systems

Interfaces between client business systems and banking services via a direct connection or an intermediate enterprise platform; includes extensions (e.g., ISO20022 customizations).

Integrate

One to Many

Components enable one-to-many integrations with multi-cloud, cloud-native and proprietary legacy-based systems, providing agility to support a wide range of client applications.

Create Workflows & Personalized Digital Services

Break down silos with automated workflows and data transfers. Delight customers with personalized digital services using pre-built components and reusable business rules.

Connect ERPs

& Business Systems

Interfaces between client business systems and banking services via a direct connection or an intermediate enterprise platform; includes extensions (e.g., ISO20022 customizations).

Integrate

One to Many

Components enable one-to-many integrations with multi-cloud, cloud-native and proprietary legacy-based systems, providing agility to support a wide range of client applications.

Create Workflows & Personalized Digital Services

Break down silos with automated workflows and data transfers. Delight customers with personalized digital services using pre-built components and reusable business rules.

Middle Text Head

Benefits of an Integrated, Digital Payments Platform

Benefits of an Integrated, Digital Payments Platform

- Reduced time, maintenance and security issues related to ERP integrations, divergent rules, policies, documentation and workflows across different business systems and enterprises

- Accelerated client onboarding and time to value for all participants

- Business agility - Integrates easily with changing and new data sources to cover any business case quickly resulting in rapid ROI

- Operational Analytics - Transactional volumes and relationships between Payers and the Payees can be monitored and optimized to grow business exponentially

- Quality Control - Ensures high data quality and accuracy with data validations at each stage and strong data reconciliation mechanisms

- Common Dashboard - Shared in real time by the payment institution and the enterprise reduces the time and cost of information reconciliation

Get Started

With Xoriant