Introduction

In today's fast-evolving financial landscape, efficiency is a necessity. As transaction volumes explode, current ledger and settlement systems are struggling to keep up. Diverse classifications of assets and increasing compliance and regulatory norms demands.

Manual reconciliations today are slow and risky because data is scattered, and systems are outdated. But as technology evolves, using AI for data transformation, smart reconciliation, and prediction is quickly becoming the new standard.

AI is trying to bring something which we define as singularity between the given finance data and AI world , once this gets some solid maturity, finance industry will witness the no-risk phase where in representative data would be a secondary vector to worry about.

AI is working to create what we define as a singularity between financial data and the AI ecosystem. Once this integration reaches a mature stage, the finance industry could enter a low-risk phase where concerns around representative data become secondary.

This blog explores how AI can empower and accelerate the finance industry in achieving this transformation.

Context: The Legacy Landscape of Settlements and Ledgers

Traditionally, ledgers have been the primary source of truth for financial transactions—a practice known as accounting. Ledgers record credits, debits, and balances. Settlements, on the other hand, mark the final stage of the transaction lifecycle, ensuring all parties have fulfilled their financial obligations.

However, conventional systems operate in silos, rely heavily on manual reconciliation, and suffer from data redundancy, delayed real-time updates, and limited fraud detection. These issues often result in regulatory non-compliance due to data inconsistencies or latency.

The result is higher operational costs, delayed settlements (typically T+2 or T+3), and increased settlement risk—conditions that are ideal for AI-driven transformation.

![]() (May the force be with you [jedi awakens...]).

(May the force be with you [jedi awakens...]).

Modern-Day Solutions: AI-Driven Ledger & Settlement Automation

Today, the rising trend of fintech is gaining strong momentum. At its core, the concept is simple—fintech operates on platforms, typically delivered via the cloud or private consortiums, offering services for:

- Digital Payments & Money Transfers

- Digital Banking & Neobanking

- Lending & Credit Services

- Personal Finance & Wealth Management

- Capital Markets & Trading Platforms

- Insurtech

- Accounting & Reconciliation Automation

- Crypto & Blockchain Applications

- AI & Data-Driven Finance

To achieve this, early fintechs faced the challenge of building scalable systems, especially in regions like South Asia and across the diverse Indian landscape. As the platform gained recognition and rapid adoption, even small vendors—like a snack seller at a railway station near the tracks—started using QR codes. (This is from my personal experience during a trip to the Himalayas—though I couldn't capture a photo as I was busy chatting with him.)

The challenge wasn’t just building scalable solutions, but also delivering them fast enough to meet market demands.

With the emergence of AI, ML, and advanced predictive models, platforms are rapidly accelerating toward achieving their core functionalities. The next section delves deeper into how this transformation is unfolding.

Modern-Day Solutions: AI-Driven Ledger & Settlement Automation

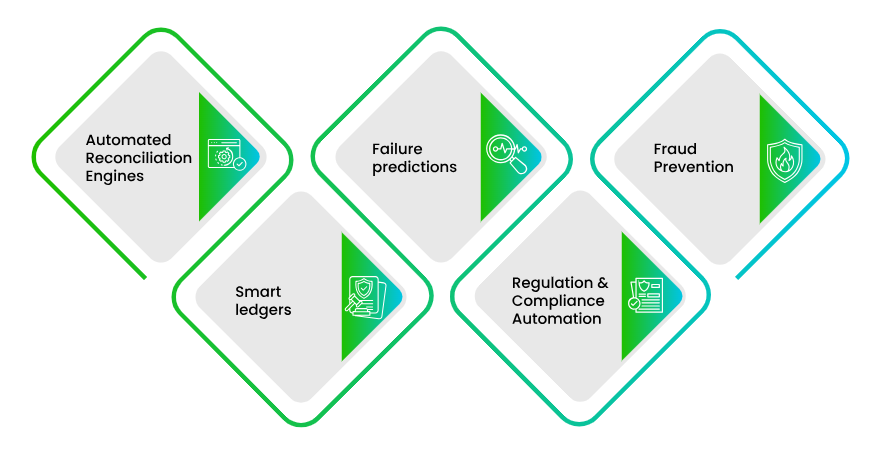

Fintechs are now harnessing AI and ML to redefine how ledgers are maintained and how settlements are executed. In other words, we are currently witnessing disruptive models reshaping trade and finance. Some key areas where this transformation is evident include:

Automated Reconciliation Engines:

Reconciliation has long been a complex and time-consuming task, whether done manually or using traditional tools. AI-powered solutions are transforming this space by ingesting data from multiple sources—such as ERPs, bank feeds, and broker reports—and automatically matching transactions. These engines can detect anomalies, mismatches, and duplicates in real time, significantly improving accuracy and efficiency.

Failure predictions:

By applying ML algorithms to trade settlement data, it becomes possible to predict potential failures in advance. This enables proactive intervention, reduces settlement breaks, and improves overall transaction reliability.

Fraud checks and score assessments:

Fraudulent transactions are an ongoing challenge for any financial platform—one that every provider aims to eliminate. AI and ML are revolutionizing fraud detection by introducing state-of-the-art algorithms that can identify suspicious patterns, flag anomalies, and respond in real time, helping platforms stay one step ahead of threats.

Smart ledgers

Blockchain-based ledgers, built on distributed ledger technology, enable real-time transactions while ensuring transparency and trust among participants. Their digital and decentralized nature makes them ideal for secure, tamper-proof financial operations.

Regulation and Compliance automation:

Automated AI-based scans are streamlining compliance processes, enabling faster turnarounds for businesses, government authorities, and end customers. AI and ML technologies are evolving beyond simple tools—they're becoming catalysts for reimagining the financial infrastructure with speed, precision, scalability, and enhanced fraud prevention.

In conclusion, AI is no longer just a back-office experiment; it’s rapidly emerging as a strategic differentiator in the financial sector’s pursuit of agility, accuracy, and compliance. As institutions continue to evolve, we are witnessing the convergence of AI, blockchain, cloud, and APIs—working together to drive the future of autonomous finance.

The adoption of AI in ledgers and settlements is not just a technical enhancement—it represents a paradigm shift toward intelligent, predictive, and self-healing financial systems. As regulatory frameworks mature and digital-first business models expand, financial institutions that embrace this transformation will not only lower operational costs but also unlock new levels of trust, efficiency, and competitive advantage.

At Xoriant, we’ve taken the lead in this space through the design, definition, and implementation of our Xonnect product platform—a state-of-the-art solution purpose-built for modern financial operations.

Get in touch with us to learn more.

View Previous Blog

View Previous Blog